Plug the leaks. Boost the margins. Listen like a leader.

Most business owners look at their financial statements to see if they’re making money. But what if we told you those same numbers could help you hire better, find hidden waste, boost productivity, and make faster, smarter decisions?

If your financial reports could talk, they’d tell you a lot more than just your net income. They’d reveal patterns, risks, opportunities, and roadblocks. This article breaks down how small to mid-sized business owners across Canada can better use their financials to support strong leadership, sound strategy, and long-term growth.

The Problem: Numbers Without Context

Many owners get overwhelmed by financial data. They rely on accountants to “do the books,” then glance at a profit-and-loss (P&L) statement each month, looking for red flags. The problem? That’s like glancing at the dashboard of your truck without watching at the road.

Your business’s numbers are only useful if they’re:

- Timely

- Understood

- Connected to day-to-day operations

Without this, financial data stays in the background when it should be informing decisions every single day.

Turning Numbers Into Insights

To make data useful, leaders need to shift from asking “What did we spend?” to “What does this tell us about how we’re running our business?”

Let’s explore how your financial reports can help uncover problems and guide smarter decisions.

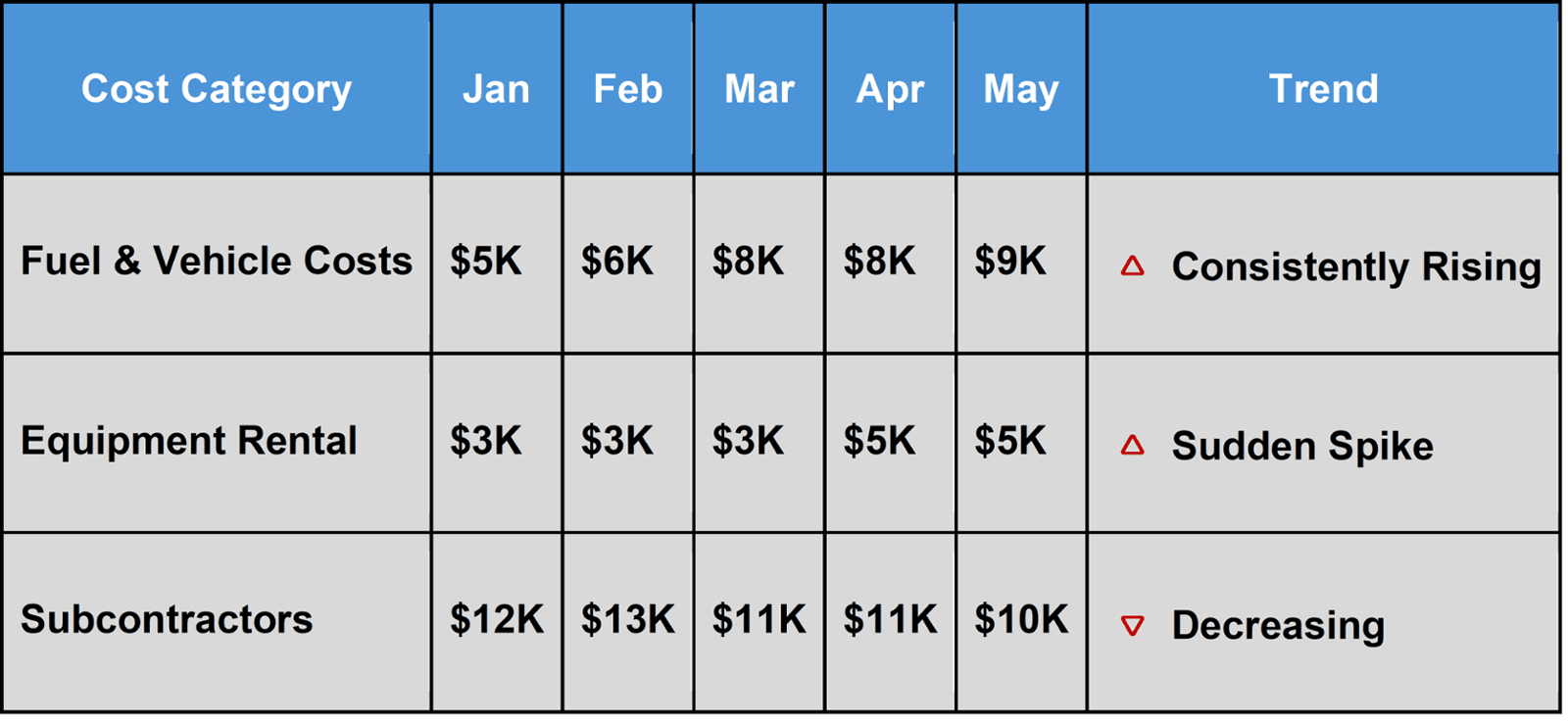

1. Spot Hidden Waste Through Trend Analysis

Looking at your cost categories over time can help identify recurring waste that isn’t obvious from a single monthly report.

In the table above, a sharp and sustained increase in fuel or rental costs should spark a conversation. Is usage going up? Is pricing changing? Are we getting the best rates?

Insight: Small leaks can sink big ships. Financial trend reports help you plug holes early.

2. Understand Profitability by Customer, Not Just Overall

Many owners know how much money they’re making in total, but not where it’s coming from. When you break profitability down by project or customer, you often find some work is barely breaking even.

A real-world example:

One Blueneck client in the trades industry learned that a single “high-volume” client was eating up 60% of the team’s time but only delivering 10% of their gross profit. After adjusting pricing and reallocating time to more profitable clients, their margins increased significantly over a few months.

Insight: Revenue is not the same as profit. Dig into the numbers to focus on work that grows your bottom line.

3. Use Financial Data to Improve Pricing Strategy

Your numbers can highlight where pricing may be too tight — or where value isn’t being captured. If you’re consistently profitable in certain service areas but losing margin elsewhere, it may be time to:

- Restructure your estimates

- Introduce minimum charges

- Adjust rates for complex or high-cost jobs

Insight: Smart pricing starts with knowing what your time, tools, and team actually cost.

4. Forecast Cash Flow to Avoid Crisis Mode

According to the US Bank report, 82% of small businesses fail due to poor cash flow management. Your financials can predict future shortfalls before they happen, if you look closely enough. Don’t let your business become a statistic!

Instead of waiting for a cash crunch, use rolling 12-month forecasts to:

- Account for seasonal revenue dips

- Plan for larger purchases or new hires

- Adjust for delayed customer payments

Insight: Use your historical data as the base, then adjust monthly with what you know is coming (e.g., a new contract or new hire).

5. Link Financials to Team Performance

Operations don’t exist in isolation from finance. If labor costs are climbing, is it because your crew is working longer hours? Or because your jobs are inefficiently scheduled?

Cross-check financials with your operations data to uncover:

- Overtime spikes due to planning gaps

- Low productivity linked to unclear job scopes

- High turnover causing training and onboarding costs to balloon

Insight: Your numbers don’t just reflect money, they reflect people. Your financial data can be a window into team performance and culture.

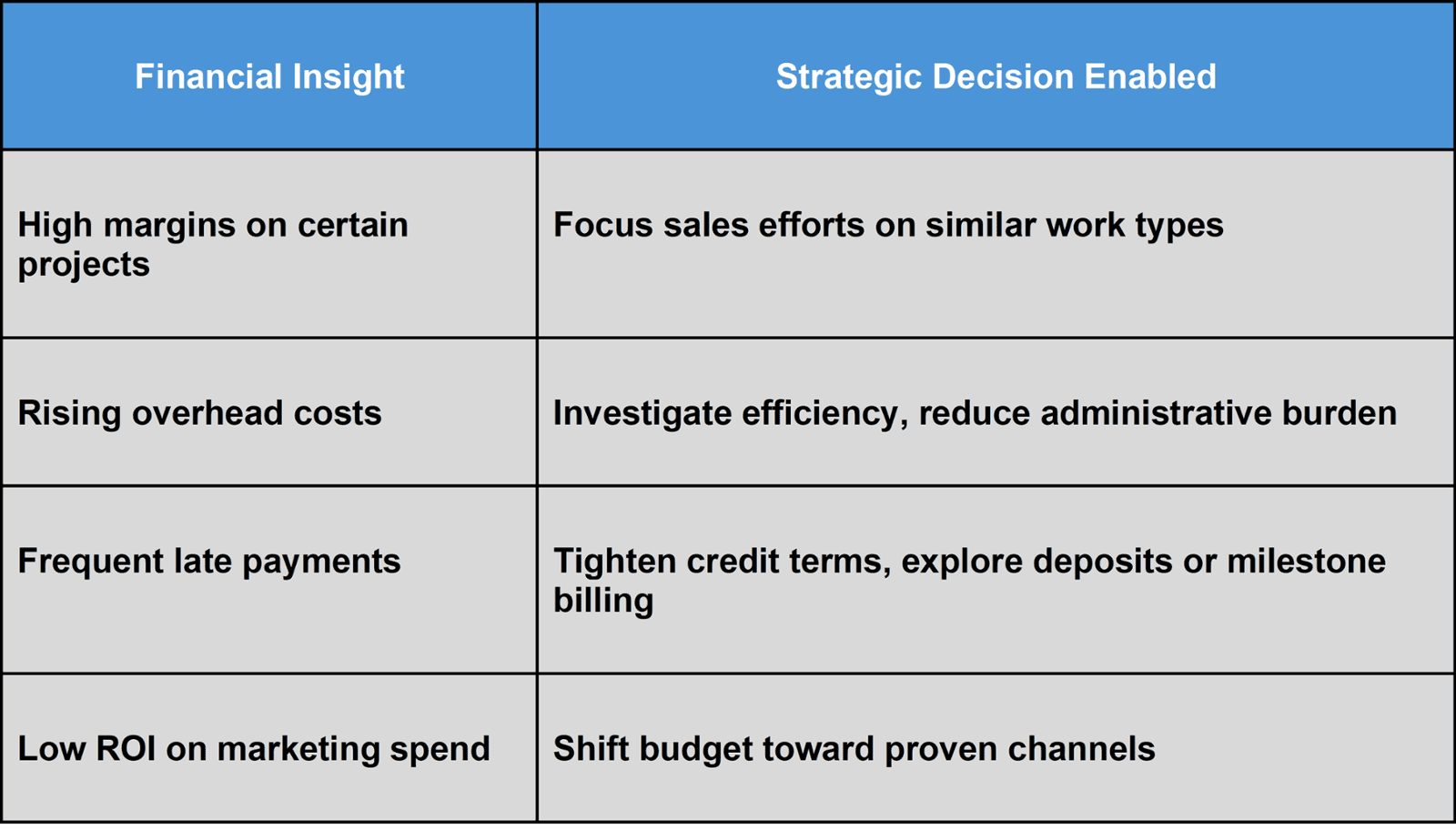

Financial Insights Create Strategic Clarity

Most business owners want clarity to three things:

- Where is my business going?

- What’s working?

- What’s getting in the way?

Financials — when reviewed in the right way — can help answer all three.

Bottom line: Financial data is your decision-making compass, not just a rear-view mirror.

You Don’t Need to Be a CFO to Understand This Stuff

You don’t need a finance degree to use your numbers effectively. But you do need:

- Clean data: Regular, accurate bookkeeping

- Clear reports: Statements that are easy to read and compare

- Curiosity: A willingness to ask “Why?” when something stands out or seems off

- Support: A strategic partner who can walk you through what the numbers mean and how to act on them

At Blueneck, we work with business owners who want better visibility but don’t have time to decode financials alone. We help connect the dots between your money, your people, and your goals.

Practical Tips to Start Listening to Your Reports

If you’re new to using financials in this way, here are a few simple steps to get started:

- Review your P&L and balance sheet monthly—but do it with someone who can help interpret the story or trends.

- Ask your bookkeeper to tag expenses by job, customer, or team if possible.

- Track labor and material costs as percentages of revenue, not just in dollars.

- Compare this year to last year, not just this month to last month.

Why Financial Clarity Builds Stronger Businesses

Financial literacy is leadership. When owners understand what their numbers are saying, they lead with confidence. They make decisions more quickly, coach their teams more effectively, and plan with greater clarity.

Harvard Business Review points out that data-driven organizations are three times more likely to improve decision-making than those that rely on instinct alone. For small businesses in the trades and services sectors, this could be the difference between steady growth and stalling out.

Final Thought: What Are Your Numbers Trying to Tell You?

Every business has a story—and your financials are one of the clearest ways to read it. But too often, owners focus only on the big numbers (like revenue or net income) and miss the signals hiding underneath. Patterns in your reports can reveal where your team is stretched too thin, where pricing needs adjusting, or where valuable time is being wasted.

When you start treating your numbers as a leadership tool—not just a compliance checklist—you gain something powerful: clarity.

At Blueneck, we believe clarity fuels confidence. That’s why we help leaders dig into the right financial insights, ask better questions, and take action with purpose.. Your financials are trying to tell you something — it’s time to start listening.

Ready to Make Smarter Business Decisions?

Let’s Talk.

Whether you want to grow, solve a stubborn issue, or simply get better visibility into your numbers, Blueneck is here to help.

Contact us today to learn more about how we support leaders across Western and Central Canada with financial insight, strategic planning, and leadership development.